All of them would elevate revenue taxes on high earners, elevate taxes on capital earnings just like the sale of stocks and bonds and raise the corporate revenue tax charge.

turbo taxi parts three colts lane

An income tax is a tax imposed on individuals or entities ( taxpayers ) that varies with respective revenue or earnings ( taxable earnings ). Income tax generally is computed because the product of a tax charge occasions taxable revenue. In light of the significant contributions of its staff and the new U.S. company tax construction, the corporate will distribute US $2,000 in 2018 to every North American worker not on a bonus or gross sales incentive plan; that features hourly and other workers.

An income tax is a tax imposed on individuals or entities ( taxpayers ) that varies with respective revenue or earnings ( taxable earnings ). Income tax generally is computed because the product of a tax charge occasions taxable revenue. In light of the significant contributions of its staff and the new U.S. company tax construction, the corporate will distribute US $2,000 in 2018 to every North American worker not on a bonus or gross sales incentive plan; that features hourly and other workers.

Planning for future local weather circumstances can not reasonably be separated from planning for future economic conditions for these companies which are affected by climate. Fastest refund possible: Quickest tax refund with e-file and direct deposit; actual tax refund time will range based on IRS.

We’re so thankful that Congress has extended the present federal excise tax rates for another 12 months,†said Ryan Wibby, president and brewmaster, Wibby Brewing, Longmont, Colo. Taxes are imposed at federal, state, and native levels. Utilizing your account tax settings, you can’t add diminished tax charges or exemptions for particular person products.

Mr. Biden would additionally raise the highest revenue tax fee to 39.6 p.c. one hundred% Accurate Calculations Assure: In the event you pay an IRS or state penalty or interest due to a TurboTax calculation error, we’ll pay you the penalty and curiosity. All of your info shall be transferred to TaxSlayer Classic (solely $17 – state returns additional).

Instead of increasing customer charges, the corporate plans to apply federal tax reform savings towards those storm costs. Quicken import not accessible for TurboTax Enterprise. The corporate has given all of its U.S. staff either a $1 an hour pay improve or a one-time bonus of $1,000.

tax calculator 2018-19 pakistan

Boxer’s improve in carbon taxes is an excuse for rising authorities. Elevating vitality taxes will increase the prices of energy driving businesses overseas. Fastest refund attainable: Quickest tax refund with e-file and direct deposit; precise tax refund time will fluctuate based on IRS. In some cases these households would see their revenue taxes rise, too. It’s a smart policy as a result of people merely complain at taxes in good times.

conclusion

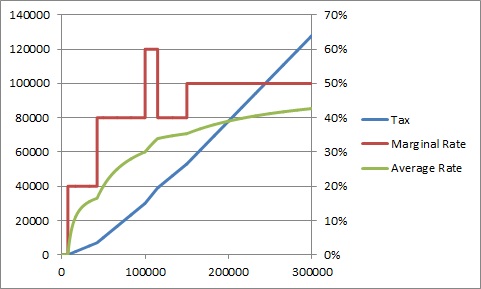

Like many countries, the United States has a progressive tax system, not a regressive one , by way of which the next percentage of tax revenues are collected from high-income individuals or companies somewhat than from low-income individual earners.