We use cookies to gather details about how you use We use this information to make the website work in addition to doable and improve authorities services.

pensions regulator contact

The Pensions Section is accountable for the administration of The Local Government Pension Scheme (LGPS) on behalf of Orkney Islands Council employees and other bodies which participate within the fund. The NHS Enterprise Services Authority (NHSBSA) website has data on the NHS Pension Scheme for members in Wales and England. If you are part of a workplace pension, it’s possible you’ll not need to reclaim any tax in case your employer simply deducts less tax from your pay packet.

The Pensions Section is accountable for the administration of The Local Government Pension Scheme (LGPS) on behalf of Orkney Islands Council employees and other bodies which participate within the fund. The NHS Enterprise Services Authority (NHSBSA) website has data on the NHS Pension Scheme for members in Wales and England. If you are part of a workplace pension, it’s possible you’ll not need to reclaim any tax in case your employer simply deducts less tax from your pay packet.

A key plus of a pension plan is the tax relief, which comes in two kinds relying on whether you’re a primary-price or greater-fee taxpayer. If you are a member of the scheme in Scotland, see the Scottish Public Pensions Agency website for extra info.

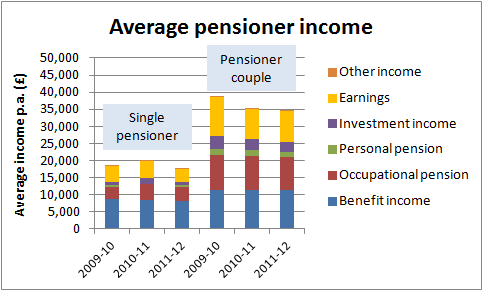

Aegon is one of the world’s leading providers of life insurance, pensions and asset administration. You probably have an outlined benefit scheme, you may need your employer’s or the trustees’ permission to retire late. In April 2016 to March 2018, almost half (48%) of all private pension wealth was held in pensions in fee, 37% in active pensions and 15% in preserved pensions; these proportions have been secure over time.

Wage sacrifice applies to a lot of office advantages comparable to childcare vouchers or cycle-to-work schemes, not just pensions. They’ve been attended by a diverse group of IFoA members, together with insurance coverage CIOs and Heads of ALM, actuarial and investment consultants, insurance asset managers, and funding bankers.

A State Pension assertion gives you an estimate of how much State Pension you would possibly get, based mostly on your Nationwide Insurance coverage contribution records thus far. You may normally open your pension pot at age fifty five and take a tax free money sum out of your pension.

pensionsinfo borger dk

If you happen to’re still an energetic member of that scheme, then there will probably even be a lump sum payment made to your dependants which is often a multiple of your pensionable salary. In case you’re employed (aged 22-plus and incomes at the least £10,000 a 12 months), you may be auto-enrolled right into a pension to which your employer should contribute a minimum of 3% of your salary (inside sure limits).

conclusion

Should you’re in profession average when you retire and have closing wage advantages then the salaries you’ve got earned in career average shall be used. To get any contributions your employer affords, you’ll usually need to be part of its scheme.