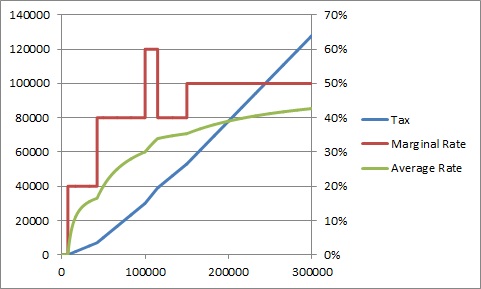

Sanders has said that he plans to tax all revenue over $29,000 to help cowl the fee for Medicare for All, which has an estimated value of $32 trillion to $36 trillion.

tax holiday adalah

You may qualify to eFile your taxes totally free. As a result of decrease rates and elevated deductions depart me with more resources to expand business operations and reward hardworking staffers. We update our software program anytime the tax laws change, so your return is guaranteed correct for the yr you’re filing.

You may qualify to eFile your taxes totally free. As a result of decrease rates and elevated deductions depart me with more resources to expand business operations and reward hardworking staffers. We update our software program anytime the tax laws change, so your return is guaranteed correct for the yr you’re filing.

Learning this info allows taxpayers to handle their finances for the most effective consequence on their internet yearly revenue. In a letter sent to employees Friday afternoon, CEO Hubert Joly said full-time staff will receive a one-time bonus of $1,000 and part-time employees $500.

We are so thankful that Congress has prolonged the current federal excise tax charges for another year,” mentioned Ryan Wibby, president and brewmaster, Wibby Brewing, Longmont, Colo. Taxes are imposed at federal, state, and local levels. Utilizing your account tax settings, you can’t add reduced tax rates or exemptions for particular person products.

There are various proposals for enhancing paid household leave, akin to Senators Invoice Cassidy (R-LA) and Kyrsten Sinema’s (D-AZ) plan , which might obtain this objective with out raising taxes or creating new entitlements. RAI and its operating firms applaud Congress and the president for bringing company income tax reform to a reality, and are utilizing this opportunity to indicate appreciation to their hard-working workers,” Howard said.

Quickest refund possible: Quickest tax refund with e-file and direct deposit; tax refund time frames will range. There’s no small business proprietor I discuss to who is not grateful to have the ability to protect one-fifth of his or her earnings from taxes.

turbotax us bank

While Democrats push a expensive new plan that will raise taxes on low-earnings employees and place new mandates on companies, the Cassidy-Sinema plan delivers the absolute best relief to families with out creating new bureaucracy or adverse results down the line. In addition, she would improve Social Security payroll taxes on excessive earners and create a new Social Safety tax on their investment revenue.

conclusion

RAI and its operating corporations applaud Congress and the president for bringing corporate income tax reform to a reality, and are utilizing this opportunity to point out appreciation to their onerous-working staff,” Howard said.